Over the past week I have crossed a radically changing North America, from Arizona to Washington DC in the US and then on to Saskatchewan in Canada, witnessing clear evidence of the consequences of historic change in the way the world economy is run. Huge uncertainty means nobody really knows where it is headed.

The walk from the White House Rose Garden to the HQ of the International Monetary Fund (IMF) takes just 9 minutes. In the past few days, in this very short stroll, two very different worlds collided with each other.

The former is the place where at the start of this month, with an extraordinary chart and questionable equation, President Trump took on the world with his so-called “reciprocal tariffs”.

The latter is the place where just three weeks on from that, after rowback, market tumult, and confusion, the finance ministers of the entire world gathered to try to pick up the pieces, even as they were still rebounding off the ground.

At the IMF meetings that included gatherings of G7 and G20 members, something unique happened. The US representatives faced not open hostility, but exasperation, bewilderment and deep concern, from almost the entire rest of the world, for having sent the global economy back towards a crisis, just as it had finally emerged from four years of pandemic, war and energy shocks.

EPA-EFE/REX/Shutterstock

EPA-EFE/REX/ShutterstockThe concern was most acutely expressed by the East Asian countries, who had in early April been classed as “looters and pillagers” of American jobs because of the fact that these economies, many of them key allies of the US, export more goods to the US than the other way around.

The talk of the G7 was the quiet determined fury of the Japanese, who were said to feel betrayed by the US turn on trade, and whose confusion over what US trade negotiators actually wanted recently sparked a sell off of US government bonds. The finance minister Katsunobu Kato told the roundtable the US tariffs were “highly disappointing”, hurting growth and destabilising markets.

I was reminded of the time at the IMF in 2022 when developing country finance ministers asked me if everything was OK in Britain during the mini budget crisis of Liz Truss’ government. Then the UK was the source of fragility, trading like an emerging market, when its normal role was solving crises in those markets.

The bugle of retreat

In the face of febrile bond markets, this week the faint sound of the bugle of retreat on the US trade war got louder. A forest of olive branches seemed to be on offer from the US to get the Chinese to come back to the table to negotiate, from respect for their economic achievements to the offer of a deal to do a “beautiful rebalancing” of the world economy. It was a far cry from the claims of “looting and pillaging”.

Yet a much hoped for meeting between US Treasury Secretary Scott Bessent and his Chinese counterpart did not materialise.

Most of the rest of the world leaving their meetings with Bessent are reporting back an assumption that the US is edging away from what it cannot acknowledge was overreach.

Reuters

ReutersAnd there is a widespread view that there is no need for countries to retaliate, when the CEOs of Walmart and Target are telling the President privately that there will be empty shelves from early May.

The collapse in container traffic from China to the port of Los Angeles – the main artery of the world economy for the first quarter of the 21st century – is the one to watch. The IMF’s boffins say they can start to see the impact from space as satellites track fewer, increasingly empty ships leaving China’s ports. Of course this will be denied by the US.

West Wing farce

It is true that there was far more relative calm at the end of the IMF Meetings compared to the beginning. Why? Because the US Treasury Secretary Scott Bessent has seized control of the tariff agenda and has almost single-handedly calmed markets and the rest of the world.

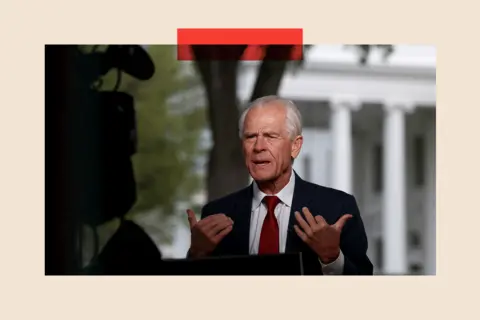

Financial diplomats put down the Bessent ascendancy and the critical 90 day pause in the so-called “reciprocal” tariffs to some farcical West Wing antics.

The story goes Bessent was able to get the ear of Trump regarding the bond market damage from his tariffs, only after a separate White House economic adviser managed to use the bait of a fake meeting to lure away the hardline tariff hawk and author of the infamous reciprocal tariff equation Pete Navarro from patrolling the Oval Office.

Reuters

ReutersWall Street bosses are thought to have suggested that only by firing Navarro, can some semblance of normality return. Insiders suggest that Trump will never get rid of his trade adviser, as he served time in jail after the January 6 riots in support of the President.

At best this sounds like the future of the world economy and all our livelihoods played out like a real time Hilary Mantel novel about the court of Trump. At worst it is leading to financiers and Governments starting to think the unthinkable about how much further the US or the rest of the world might go and currently, the uncertainty about everything is more concerning than the direct impact of the tariffs.